BFC Online Learning—education of tomorrow

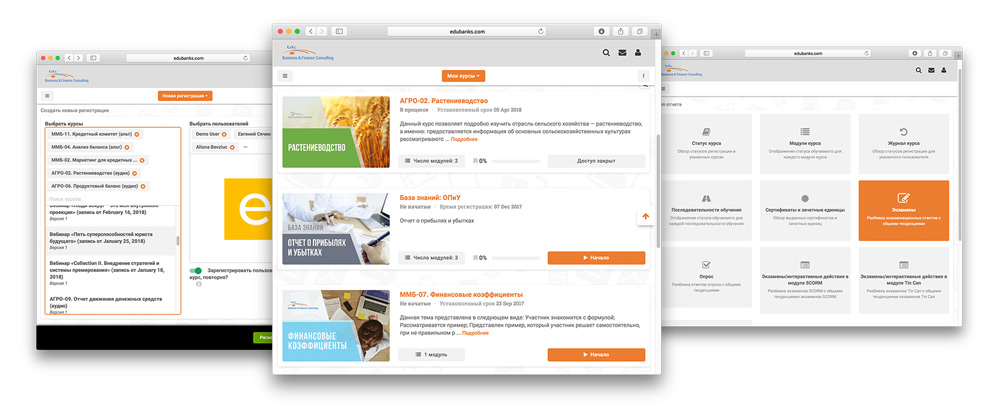

+

Learners every year

+

New courses

+

Test questions

Why online learning and what we aim to change?

ABOUT

- Knowledge transfer in a modern, easy-to-use format

- Reduce training costs

- Make trainings accessible to everyone, anywhere and anytime

- Strengthen staff skillset

- Promote new forms of learning

BFC’s principles of effective learning

PRINCIPLES

-

Deep and practical knowledge conveyed across training topics

-

Simulation of real-time cases

-

Focus on skills development to achieve business goals

-

Use of digital learning technologies as motivation toward better performance.

Who are our clients?

Financial Organisations that are:

-

Geographically dispersed or have wide branch network

-

Actively developing and training their staff

-

Seeking healthy and stable portfolio growth

-

Working to keep pace with global trends in learning and development

Benefits of online learning

For staff

- Modern, user-friendly platform interface

- Mobile friendly and learning convenience

- Self-paced learning

- Remote skills development

For the organization

- Reduced training budgets and travel costs

- Greater opportunities for training and motivating staff

- Staff training in remote regions

- Flexible learning paths for various user groups

- Convenient on-boarding of new staff

- Customized reporting tool-kits

- Automated learning performance management

BFC offers

1. Secured and private branded portal

- Full control over the training process

- Guided training of trainers for effective use of the portal

- Management of the BFC course catalog

- Course-builder toolkit to create new courses, pools, tests, surveys

- Full access to reporting toolkits

- Remote technical support (via portal, forum and instant messengers in WhatsApp, Viber, Telegram)

2. BFC’s course catalog

- 50+ courses for loan officers

- Webinars on a variety of professional topics

- Staff testing and certification

- Knowledge base

Target audience

Loan officers, department heads, underwriters and other small business lending staff responsible for evaluating borrower's creditworthiness.

Contents:

Target audience

Loan officers, department heads, underwriters and other MSE agrilending staff responsible for evaluating borrower's creditworthiness.

Contents:

Target audience

Loan officers, department heads, underwriters, analysts and other staff involved in financial analysis of SMEs.

Contents:

Potential gains

min 30%

enhanced financial analysis skills

up to 30%

increased lending efficiency

up to 20%

less non-performing loans

up to 40%

increased loan portfolio

up to 50%

less training expenses

Quantitative effect

- Audit of the training system

- Recommendations for introducing a systematic approach to training

- Distance learning strategy that includes a learning management system, knowledge-testing tools and certification

- Loyal and competent staff

- Satisfied customers and improved service quality

- Stable loan portfolio growth with minimal risk

- Development of a learning culture and an organizational community

Over 90% staff members are willing to actively learn if they understand the benefits of it

Contact Us

PRICING

BFC offers product bundles and helps financial institutions launch effective training systems aligning to their specific organizational needs.

The cost of service is determined by number of learners and modules included in training package. We provide our clients with the best value services at high-class quality.